Slow demand for forest industry products

Following two peak years, the demand for forest industry products has clearly weakened in key market areas. The construction sector is suffering from inflation, high interest rates and general uncertainty. The effects are transmitted to the Finnish forest industry’s domestic production, exports, felling volumes and roundwood trade. However, the demand for forest industry products is expected to slightly recover next year, according to the Finnish forest sector economic outlook by Natural Resources Institute Finland (Luke).

Sluggish market outlook for sawnwood

In 2023, the exports and production of Finnish sawnwood are forecasted to decrease by eight per cent from last year. The reasons for this include high interest rates, increased costs, and economic uncertainty, which are reflected in the construction volumes in many important markets.

The weak situation in the sawnwood market will also continue next year. The recovery of construction and the demand for sawnwood will not begin in the important export markets in Europe until in the second half of 2024. The production and exports of Finnish sawnwood are forecasted to strengthen only slightly from this year during 2024. The average export price of sawnwood is expected to remain four per cent below that of 2023 next year.

The production and exports of plywood are forecasted to strongly decrease in 2023 from last year. The exports of softwood plywood have diminished with the slowing of construction activities in Europe, and the production in Finland has been restricted at the same time. The production and exports of birch plywood are hindered by the availability of birch sawlogs. Even though the long increase in export prices of plywood ended in the summer of this year, the average export price of plywood for this year will still be four per cent higher from the previous year. In 2024, the production and exports of plywood are forecasted to remain at the same level as this year and the average export price to decrease by eight per cent.

The production volumes of the chemical forest industry decline from last year

In 2023, the production and export volumes of paperboard will decrease by more than a fifth from last year. The market situation is weak and consequently, the capacity utilisation rates are record low. The demand for paperboard is weakened by declining private consumption and the reductions of buyers’ inventory levels. The average export price of paperboard will decrease by three per cent this year. However, the decrease in the export prices is expected to stop during the last part of the year. Even though the prices are anticipated to turn to a rise in 2024, the average export price will still decrease from this year by six per cent. The production and exports of paperboard will grow by four per cent next year.

In 2023, paper production and exports from Finland will decrease by ten per cent from last year. In addition to the weak demand and the unloading of customers’ inventories, the decline in production is driven by the reduction in production capacity. Slow economic growth will also keep demand weak next year. The situation is estimated to return somewhat to normal following this year’s drop. Finland’s production and export volumes will grow by a couple of per cent. Even though the drop in paper export prices is levelling off, the average export price will remain seven per cent lower than last year. Next year, the average export price will further decrease by more than 13 per cent.

Weak economic growth, poor demand for printing and writing papers and paperboard in Europe, and high inventory levels will keep the chemical pulp market slow this year. However, chemical pulp exports from Finland will grow by 11 per cent this year due to the weak production levels last year and the start-up of Metsä Group’s new mill in Kemi. The total production volumes of chemical and mechanical pulp, on the other hand, will remain lower than last year with the considerable drop in paper and paperboard production volumes.

In 2024, chemical pulp exports from Finland will grow even faster than this year due to higher production capacity, even though weak economic growth in important markets will keep the demand for pulp lower than in the last few years. Driven by exports, the total production volumes of chemical and mechanical pulp will also increase considerably. The average export prices of chemical pulp will significantly decrease both this and next year.

Diminishing demand slows down roundwood trade, scarcity of roundwood continues

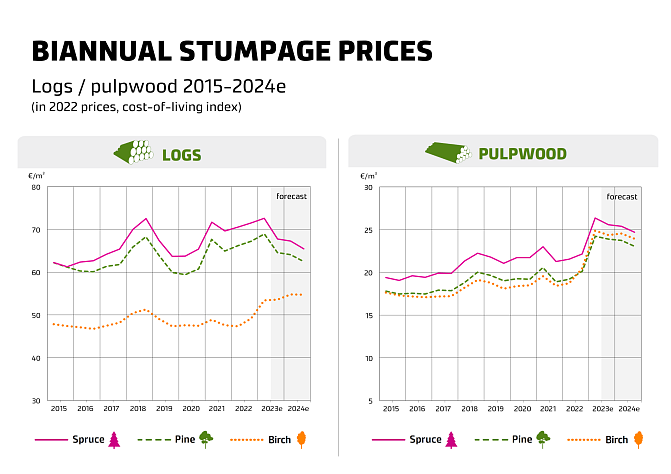

The stumpage prices of roundwood reached their highest level by the summer of 2023. Since then, economic recession and declining demand for forest industry products have significantly slowed down roundwood trade, and the stumpage prices have begun to decrease. Industrial roundwood fellings are forecasted to decline by seven per cent from last year to 59.4 million cubic metres. With the busy first half of the year, the average annual stumpage prices will increase by 5–6 per cent for pine and spruce logs, 17 per cent for birch logs and 26–33 per cent for pulpwood. A total of 4.9 million cubic metres of roundwood will be imported, which is two per cent more than in the previous year.

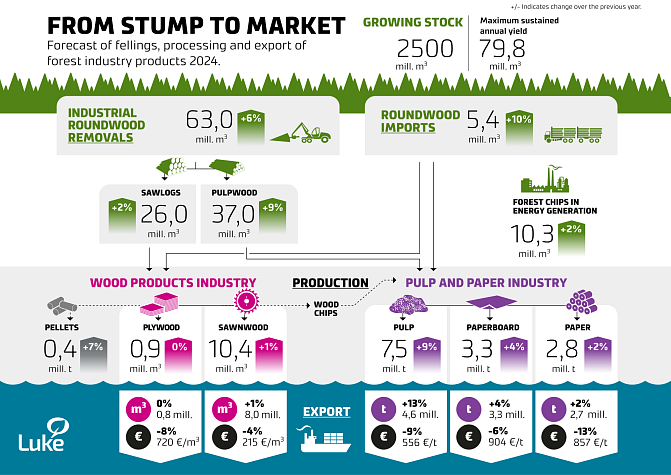

The forest industry’s capacity and production will grow in 2024, and the scarcity of roundwood will restrain the decline of stumpage prices. The stumpage prices of pine and spruce logs will decrease by four per cent, following the decreasing sawnwood prices. The stumpage price of birch logs used for plywood will increase by five per cent. Due to previously purchased roundwood stocks, industrial roundwood fellings will increase by six per cent to 63 million cubic metres. The growth of the production of chemical pulp, paperboard and paper will increase thinning, the main source pulpwood. As the harvesting costs increase, the average stumpage prices of pulpwood will decline by 0–2 per cent. Due to increasing demand for pulpwood, roundwood imports are forecasted to rise by a tenth to 5.4 million cubic metres.

Gross stumpage earnings from non-industrial private forestry are forecasted to decrease in real terms from the previous year in 2023, even though the earnings in euros will increase to nearly EUR 2.6 billion. In 2024, the earnings will continue to decrease by a few per cent in real terms, while remaining nominally at nearly the same level as in 2023.

The use of forest chips and wood pellets on the rise

The weakening availability of forest industry by-products and the discontinuation of the imports of Russian wood chips keep the demand for domestic forest chips used as fuel at heat and power plants high. As a result, several million cubic metres of pulpwood may also be burned. In 2023, the use of forest chips is expected to remain at the same level as in the previous year, at 10.2 million cubic metres. The use will slightly increase in 2024. The mill-gate price of forest chips is anticipated to increase by 20 per cent this year and by 2–5 per cent next year.

Domestic wood pellet production is restricted by the availability of raw materials. In 2023, the pellet production is expected to grow by nearly six per cent to 380,000 tonnes. In 2024, the production volume is anticipated to further increase by 20,000–30,000 tonnes.

Additional information:

- Economic development: Jari Viitanen

- Wood products industries: Antti Mutanen

- Pulp and paper industries: Matleena Kniivilä

- Paperboard industry: Emmi Haltia

- Profitability of forest industry: Esa-Jussi Viitala

- Forest sector labour force: Marja Kallioniemi

- Roundwood markets: Jussi Leppänen

- Bioenergy markets: Johanna Routa

- Non-industrial private forestry: Esa Uotila